Investir dans des montres de luxe peut être une aventure financière enrichissante et une occasion de profiter de magnifiques créations artisanales. Cependant, pour maximiser les retours, une approche stratégique est nécessaire. La première étape consiste à rechercher des marques établies comme Rolex, Patek Philippe et Audemars Piguet, qui ont la réputation de conserver ou d'augmenter leur valeur au fil du temps. Construire une liste de montres basée sur des facteurs tels que la rareté, la marque et l'état est une étape essentielle du processus.

Bien que les montres de luxe puissent être rentables, il est important d'être conscient des risques, tels que les fluctuations du marché et les défis de liquidité. Cependant, avec la bonne stratégie et des décisions éclairées, investir dans des montres de luxe peut être une entreprise lucrative et agréable.

Avantages d'Investir dans des Montres de Luxe

Investir dans des montres de luxe présente plusieurs avantages :

- Symbole de Réussite et de Statut

- Événements marquants et style : Les montres de luxe célèbrent des événements importants et reflètent le style et le succès. Elles deviennent souvent des symboles de réussite personnelle et peuvent revêtir une signification historique.

- Héritage : De nombreuses montres haut de gamme sont transmises comme des héritages familiaux, alliant valeur émotionnelle et valeur financière durable.

- Stabilité Financière et Économique

- Actifs portables : Contrairement à l'immobilier ou à d'autres investissements, les montres de luxe sont portables et peuvent être stockées ou transportées en toute sécurité.

- Potentiel d'appréciation : Les montres des marques respectées ont tendance à prendre de la valeur avec le temps, offrant un investissement solide.

- Résilience en période de crise : En période de ralentissement économique, les montres de luxe tendent à être plus stables. Par exemple, pendant la pandémie de 2022, le marché des montres n'a chuté que de 8 %, tandis que le S&P 500 a chuté de 19 %.

- Investissement et Diversification

- Appréciation prouvée : Les montres de marques prestigieuses comme Rolex et Patek Philippe ont démontré une croissance constante de leur valeur, certains modèles ayant apprécié en moyenne de 14 % par an depuis les années 1990.

- Diversification : Les montres offrent une classe d'actifs unique pour diversifier un portefeuille, agissant comme un rempart contre l'inflation.

Facteurs Déterminant la Valeur d'une Montre

Lorsque vous investissez dans des montres de luxe, plusieurs facteurs clés influencent leur valeur potentielle :

- Reconnaissance de la marque : Les montres de marques renommées telles que Rolex et Omega tendent à conserver leur valeur grâce à leur réputation en matière d'artisanat et de qualité.

- État et entretien : Une montre bien entretenue et en excellent état est plus précieuse qu'une montre montrant des signes d'usure. Un entretien régulier permet de préserver à la fois l'apparence et la fonctionnalité de la montre.

- Rareté et exclusivité : Les modèles en édition limitée ou ceux avec des caractéristiques uniques commandent généralement des prix plus élevés.

- Facteurs supplémentaires : Des éléments tels que la patine (vieillissement naturel), l'intégralité (boîtes et papiers d'origine), les associations avec des célébrités, les matériaux (métaux précieux) et les mécanismes complexes (par exemple, les chronographes ou les phases de lune) influencent également la valeur marchande d'une montre.

Modèles Discontinués et leurs Impacts Potentiels en 2025

Un grand nombre de modèles ont été interrompus en 2024, ce qui constitue toujours un facteur important lorsqu'on examine le marché global et les potentielles montres d'investissement futures. Quelques modèles qui ont été arrêtés incluent :

- Rolex Daytona 'Le Mans'

- Rolex Yacht Master II (Collection entière à l'exception de l'original)

- Patek Philippe Nautilus - 5980/1R / 5712R / 5712G Moon Phase

Cela peut avoir un impact significatif sur la valeur des montres d'occasion de ces collections ou de ces modèles spécifiques, car elles deviendront désormais des actifs limités sur le marché. Bien que cela ne les rende pas nécessairement des choix instantanés pour des pièces d'investissement, c'est certainement quelque chose à garder en tête lors de la recherche d'une montre d'investissement en 2025.

Étapes pour Commencer à Investir dans des Montres de Luxe

Pour commencer à investir dans des montres de luxe, voici les étapes à suivre :

- Définir un budget : Les montres de luxe peuvent aller de 10 000 à 15 000 € pour des modèles d'entrée de gamme, à des prix bien plus élevés pour des pièces premium. Établissez un budget clair en fonction de vos objectifs financiers.

- Préférence personnelle : Choisissez des montres qui correspondent à votre style et à vos goûts personnels, car vous voudrez aussi en profiter au quotidien.

- Faites vos recherches :

- Apprenez sur les marques et les modèles : Comprenez les caractéristiques des marques iconiques et de leurs modèles, y compris ce qui rend certaines montres plus précieuses.

- Créez une liste de montres : En fonction de vos recherches, compilez une liste de montres qui répondent à vos critères de valeur et de désirabilité.

- Surveillez le marché : Restez à jour sur les tendances et les évolutions du marché pour savoir quand il est temps d'acheter ou de vendre.

- Faites votre achat : Décidez d'acheter en ligne ou en magasin, en tenant compte de l'authenticité et de la différence de prix.

- Planifiez la revente : Pensez à long terme et établissez une stratégie de sortie pour vendre votre montre au moment opportun.

Montres Neuves vs. Montres d'Occasion pour l'Investissement

Le choix entre des montres neuves et des montres d'occasion dépend de vos objectifs d'investissement. Chaque option présente des avantages distincts :

- Montres neuves :

- État et garantie : Les montres neuves sont couvertes par une garantie du fabricant et sont dans un état impeccable.

- Dépréciation : Les montres neuves perdent de la valeur dès qu'elles sont achetées, ce qui peut être un inconvénient pour un retour rapide.

- Montres d'occasion :

- Appréciation de la valeur : Les montres d'occasion, en particulier les modèles rares ou discontinués, ont le potentiel d'apprécier en valeur.

- Économies : Les montres d'occasion coûtent généralement moins cher que les neuves, offrant ainsi une entrée plus abordable dans le monde des montres de luxe.

- État et authenticité : Il est essentiel de vérifier l'état de la montre et de s'assurer qu'elle est accompagnée de sa documentation d'origine.

Meilleures Marques pour Investir dans des Montres d'Occasion

Pour les montres de luxe d'occasion, plusieurs marques performent bien de manière constante :

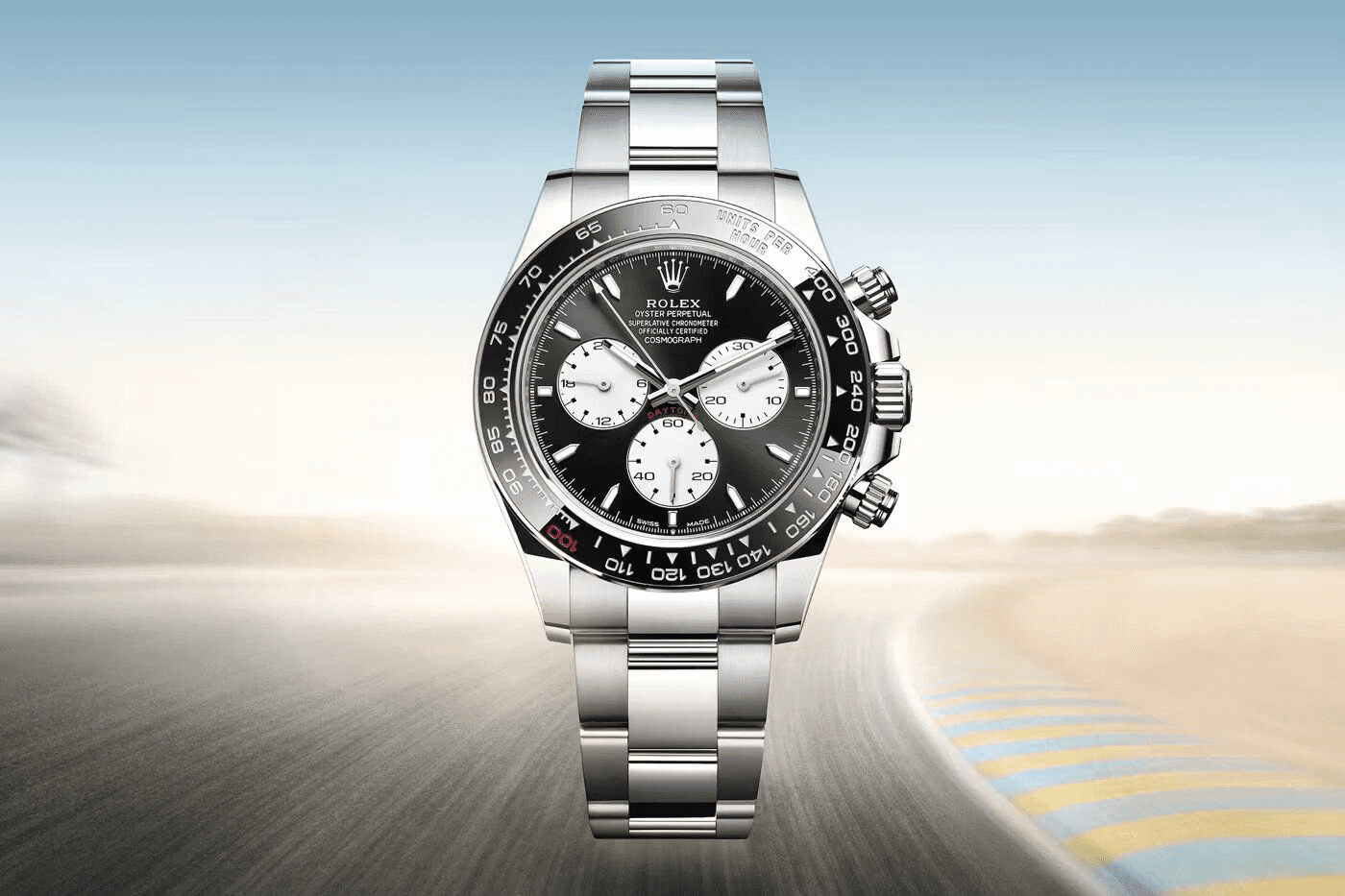

- Rolex : Connu pour la rétention de la valeur, des modèles iconiques comme le Datejust, le Submariner et le Daytona sont très recherchés.

- Omega : Le Speedmaster et le Seamaster sont des choix favoris des collectionneurs.

- Patek Philippe : Leurs montres sont réputées pour leur qualité et leur potentiel d'investissement.

- Jaeger-LeCoultre : Connu pour un artisanat exceptionnel, leurs modèles conservent également leur valeur au fil du temps.

Meilleures Montres pour un Investissement de Qualité

Certaines montres sont particulièrement adaptées à l'investissement, qu'elles soient neuves ou d'occasion :

- Modèles neufs :

- Rolex Daytona Cosmograph : À 14 800 $, il est populaire parmi les collectionneurs.

- Patek Philippe Nautilus : À 31 940 $, il est très convoité pour son design élégant.

- Audemars Piguet Royal Oak : Évaluée à 63 900 $, ce modèle est une référence dans le monde des montres de luxe.

- Modèles d'occasion :

- Rolex Datejust (Référence 1601) : Prix entre 3 500 et 6 000 $, c'est une option accessible pour les collectionneurs de Rolex.

- Omega Speedmaster Moonwatch Professional : Un modèle historique, au prix d'environ 6 600 $, avec un fort suivi parmi les collectionneurs.

Principales Marques de Montres pour Investir

Certaines marques de montres ont plus de chances de fournir des rendements constants sur investissement :

- Rolex : Des modèles comme le Submariner, le Daytona et le GMT-Master II ont prouvé leur longévité et leur appréciation.

- Patek Philippe : Le Nautilus et l'Aquanaut sont particulièrement précieux pour les investisseurs.

- Audemars Piguet : Le Royal Oak est particulièrement recherché pour son artisanat et sa haute valeur de revente.

- Omega : Des montres comme le Speedmaster et le Seamaster sont vénérées par les collectionneurs et conservent leur valeur.

Comment Stocker des Montres d'Investissement

Un stockage approprié est crucial pour maintenir la valeur de vos montres de luxe. Voici quelques conseils de stockage :

- Boîtes et remontoirs : Ils protègent les montres de la poussière et des rayures et assurent que les montres automatiques gardent un temps précis.

- Conditions environnementales : Gardez les montres dans un endroit frais et sec, à l'abri de l'humidité et de la lumière directe.

- Sécurité : Pour les pièces de grande valeur, utilisez un coffre-fort ou une boîte de sécurité.

- Entretien régulier : Assurez-vous que les montres soient entretenues par un professionnel pour maintenir leur fonctionnalité.

Conclusion

Investir dans des montres de luxe offre à la fois des récompenses émotionnelles et un potentiel de gain financier. En tenant compte de facteurs tels que la réputation de la marque, l'état, la rareté et la demande du marché, les investisseurs peuvent prendre des décisions éclairées. Que ce soit pour l'achat de modèles neufs ou d'occasion, une approche soignée peut mener à des rendements significatifs et au plaisir de posséder des pièces intemporelles de l'artisanat.

Notre équipe dispose d'une expertise sur le marché et nous serons ravis de discuter de vos besoins d'investissement et de ce que vous recherchez lorsqu'il s'agit de choisir une montre d'investissement.

$ (USD)

$ (USD)  £ (GBP)

£ (GBP)